New Federal Debt Relief Programs 2025: Cut Your Payments by 30%

Navigating the federal debt landscape can be complex, but new relief programs in 2025 offer a tangible pathway for many Americans to significantly reduce their monthly loan obligations, potentially cutting payments by up to 30%, by optimizing existing structures and introducing new benefits.

For millions across the United States, the burden of debt can feel overwhelming. Whether it’s student loans, medical bills, or other forms of federal obligations, managing these payments often strains household budgets. The good news is that How the New Federal Debt Relief Programs in 2025 Can Cut Your Payments by Up to 30% provides a much-needed beacon of hope, offering tangible solutions to alleviate financial pressure and free up critical funds for other life necessities.

Understanding the Debt Landscape in 2025

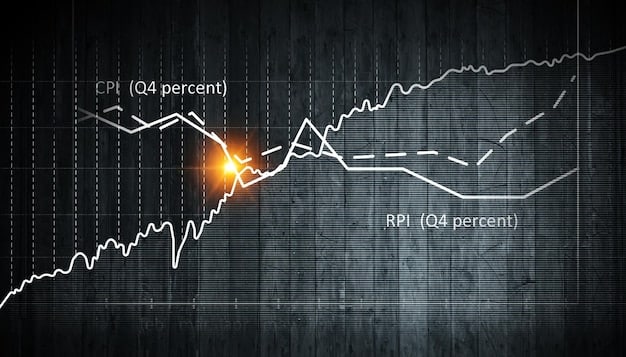

The economic climate in 2025 continues to present unique challenges, with inflation, interest rate fluctuations, and unexpected financial setbacks contributing to rising debt levels for many American households. This complex scenario underscores the critical need for effective debt management strategies, particularly those supported by federal initiatives. Many individuals find themselves juggling multiple payments, each with varying terms and interest rates, leading to a sense of being perpetually behind. It’s not just about the numbers; it’s about the mental and emotional toll that debt can take, impacting overall well-being and future financial planning.

The federal government, recognizing these widespread challenges, has consistently sought to introduce and refine programs designed to offer relief. These programs are not merely temporary fixes; many are structured to provide long-term, sustainable solutions that address the root causes of financial strain. By understanding the current debt landscape, individuals can better appreciate the value and necessity of these new initiatives. It’s a proactive step towards financial stability, offering a clear path out of burdensome payment cycles. The goal is to empower citizens with the tools and knowledge to take control of their financial destinies, fostering a more secure economic future for everyone.

The Evolution of Federal Debt Relief

Federal debt relief programs have a long history, adapting over time to meet the evolving needs of the population. Initially, many programs focused on specific types of debt, like student loans, offering basic repayment plans. However, as the financial landscape shifted, so did the approach to relief. Newer programs are more comprehensive, often taking into account a broader range of financial circumstances and offering more flexible solutions. This evolution reflects a growing understanding that debt is a multifaceted issue requiring nuanced solutions. The aim is not just to reduce payments but to provide a pathway to complete financial recovery and resilience.

These changes haven’t been arbitrary; they are the result of extensive research, economic analysis, and feedback from consumers and financial experts alike. The government’s commitment to continuous improvement ensures that the programs remain relevant and effective, particularly in an ever-changing economic environment. Individuals benefit from these continuous refinements, as they gain access to a wider array of options and potentially more favorable terms. This proactive stance helps prevent financial distress from spiraling out of control, offering interventions before situations become unmanageable.

- Historical Context: From basic deferments to comprehensive repayment plans.

- Adapting to Economic Shifts: Programs continually modified to address inflation, interest rates, and employment changes.

- Broader Eligibility: Modern programs aim for more inclusive criteria, reaching a wider demographic.

- Focus on Sustainability: Emphasizing long-term solvency rather than temporary fixes.

Why 2025 is a Pivotal Year

The year 2025 marks a significant turning point for federal debt relief. New legislation and program adjustments are set to take effect, designed to enhance the accessibility and impact of relief efforts. These changes are not incremental; they represent a concerted effort to provide substantial relief to millions of Americans. Many of these adjustments are a direct response to lessons learned from previous economic challenges, aiming to create a more robust and responsive framework for debt management. The programs introduced now are expected to redefine how individuals approach their federal debt obligations.

Crucially, these upcoming changes can offer immediate and tangible benefits, such as reduced monthly payments and more manageable repayment timelines. Staying informed about these developments is not just advised; it’s essential for anyone carrying federal debt. The new year brings fresh opportunities to re-evaluate financial strategies and leverage governmental support to achieve greater economic freedom. It’s a moment for individuals to actively engage with the resources available and transform their debt situation from a burden into a manageable part of their financial journey.

Key Federal Debt Relief Programs for 2025

In 2025, several federal debt relief programs are poised to offer significant advantages to eligible borrowers. These programs are designed to address various types of federal debt, with a particular emphasis on student loans, which represent a substantial portion of the national debt burden. Understanding the nuances of each program is crucial for maximizing potential savings and ensuring long-term financial stability. These initiatives reflect a broader governmental effort to ease financial strain and promote economic mobility for individuals and families across the country.

Income-Driven Repayment (IDR) Enhancements

Income-Driven Repayment (IDR) plans have long been a cornerstone of federal student loan relief, designed to make monthly payments affordable based on a borrower’s income and family size. In 2025, new enhancements to these IDR plans are set to make them even more attractive and effective. These improvements aim to simplify the application process, expand eligibility, and ensure that payments remain truly manageable, adapting to changing financial circumstances. The core idea is to prevent borrowers from being overwhelmed by their student loan obligations, particularly during periods of low income or unemployment.

One of the most impactful changes involves adjusting the discretionary income calculation, which often results in lower monthly payments for many borrowers. Furthermore, programs are being streamlined to ensure that interest accrual does not lead to ballooning balances, even if payments are low. This helps to prevent the feeling of being in an endless repayment cycle, offering a clearer path to eventual loan forgiveness. These enhancements are critical in helping borrowers stay on track and avoid default, while also providing a safety net during challenging economic times. The goal is to provide a more compassionate and realistic approach to student loan repayment, acknowledging the diverse financial realities of borrowers.

- Lower Discretionary Income Calculation: Reduces monthly payment amounts for many.

- Interest Control: Mechanisms to prevent unpaid interest from increasing loan balances.

- Streamlined Application: Easier process for enrolling and recertifying IDR plans.

- Expanded Eligibility: More borrowers may qualify for reduced payments under new guidelines.

Public Service Loan Forgiveness (PSLF) Modifications

The Public Service Loan Forgiveness (PSLF) program has been a lifeline for dedicated public servants, offering forgiveness of their remaining federal student loan balance after 120 qualifying monthly payments. In 2025, the program is undergoing significant modifications designed to address past complexities and expand access to forgiveness. These changes are a direct response to feedback from public service workers who have often faced challenges navigating the program’s strict requirements. The objective is to make PSLF more accessible and reliable, ensuring that those who commit their careers to public service are properly rewarded.

These modifications often include simplifying eligibility criteria for employment and payment types, as well as providing clearer guidance on what counts as a “qualifying payment.” The intent is to remove administrative hurdles that historically prevented many eligible borrowers from receiving forgiveness. With these changes, a greater number of teachers, nurses, firefighters, and other public service professionals can expect to benefit. The enhanced PSLF program reinforces the value of public service and provides a powerful incentive for individuals to pursue careers that benefit their communities, without the overwhelming burden of student loan debt.

New Initiatives for Other Federal Debts

While student loans often dominate the discussion around federal debt, new initiatives in 2025 also extend to other types of federal obligations, offering broader relief. These encompass a range of debts administered by various federal agencies, including FHA mortgages, VA loans, and certain types of agricultural or small business loans. The approach is holistic, aiming to provide a safety net for individuals and businesses facing difficulties with federal debt beyond just education. This expansion highlights a comprehensive strategy to bolster financial resilience across different sectors of the economy.

These new programs might include more flexible refinancing options, temporary payment deferrals, or even targeted forgiveness programs for specific circumstances. For instance, homeowners with FHA loans struggling due to economic downturns might find enhanced forbearance options or pathways to loan modification. Veterans utilizing VA loans could see improved access to financial counseling and default prevention services. The key is to recognize that federal debt is diverse, and the solutions must be equally varied to meet the distinct needs of different borrower groups. Staying informed about these specific departmental initiatives is crucial for affected individuals.

Eligibility and Application Process

Navigating the eligibility requirements and application process for federal debt relief programs can sometimes be daunting. However, understanding the key criteria and following a structured approach can significantly streamline the experience. The aim of these processes is to ensure that relief is provided to those who genuinely need it, while maintaining the integrity and sustainability of the programs. It is imperative for applicants to pay close attention to detail and compile all necessary documentation to avoid delays or rejections.

General Eligibility Criteria

While specific program requirements vary, several general eligibility criteria are common across most federal debt relief initiatives. Typically, borrowers must be U.S. citizens or eligible non-citizens, and their debt must be federal in nature, rather than private. Financial hardship is a recurring theme, often assessed through income levels, family size, and other economic indicators. For some programs, a history of consistent payment (even if minimal) or a demonstrated attempt to manage debt proactively can be an advantage. The government designs these criteria to target relief where it can have the most impact and where it aligns with socio-economic policy goals.

It’s also common for programs to consider the type of debt. For example, student loan relief programs are distinct from those for federal housing loans or agricultural loans. Furthermore, borrowers may need to be in good standing or not in default on other federal obligations, though some programs specifically address default situations. Understanding these foundational requirements is the first step in determining which programs might be applicable. A thorough review of program guidelines is always recommended before initiating an application.

Required Documentation

The application process for federal debt relief programs typically requires a range of documentation to verify eligibility and financial status. This often includes proof of income, such as recent tax returns or pay stubs, to assess financial need. Depending on the program, family size may also be a factor, requiring documentation like birth certificates or dependency verification. For student loan programs, borrowers will need to provide their Federal Student Aid ID and details of their loan accounts. The more organized and complete your documentation, the smoother the application process will likely be.

Applicants may also need to provide personal identification, such as a driver’s license or state ID, and proof of residency. In cases where specific hardship is claimed, supporting documents like medical bills, unemployment records, or eviction notices might be necessary. Some programs, particularly those related to public service, will require employment certification from employers. Gathering these documents in advance can save considerable time and reduce stress during the application period, ensuring that you can submit a complete and accurate request for relief.

- Proof of Income: Tax returns, pay stubs, and other income statements.

- Identification: Government-issued ID and social security number.

- Loan Documents: Account statements, loan numbers, and servicer information.

- Family Information: Documentation supporting family size or dependents.

- Hardship Evidence: Relevant records for specific hardship claims (e.g., medical, unemployment).

Step-by-Step Application Guide

Applying for federal debt relief shouldn’t be an intimidating process if approached systematically. Start by thoroughly researching the specific programs that align with your debt type and financial situation. Many government websites offer detailed overviews and eligibility checkers. Once you’ve identified potential programs, gather all necessary documentation as outlined in the program’s guidelines. Accuracy is paramount here; even small errors can lead to delays. The next step typically involves completing an online application form or submitting physical paperwork. Be meticulous in filling out every field and providing truthful information.

After submission, it’s crucial to track the status of your application. Many agencies provide online portals or contact numbers for status inquiries. Be prepared to respond promptly to any requests for additional information or clarification from the program administrators. If your initial application is denied, don’t despair; understand the reasons for denial and explore options for appeal or reapplication, addressing the identified deficiencies. Sometimes, a denial simply means a different program might be a better fit. Persistence and attention to detail are key to successfully navigating the application journey and securing the debt relief you need.

Impact and Benefits of Reduced Payments

The ability to reduce monthly debt payments by up to 30% through new federal programs in 2025 offers a cascade of positive impacts and significant benefits for individuals and the broader economy. This relief is not just about freeing up cash flow; it’s about providing a foundation for greater financial stability and peace of mind. For many, this adjustment can mean the difference between struggling to make ends meet and having the capacity to invest in their future. The psychological effect of lighter debt burdens is also profound, reducing stress and improving overall well-being.

Boosting Household Budgets

One of the most immediate and tangible benefits of reduced debt payments is the significant boost to household budgets. A 30% reduction can translate into hundreds of dollars saved each month, which can then be reallocated to other essential expenses. For families living paycheck to paycheck, this additional disposable income can be transformative, allowing them to cover groceries, utilities, or healthcare costs without resorting to further borrowing. It creates a much-needed buffer against unexpected financial shocks, improving financial resilience in the face of emergencies.

This freed-up cash also provides an opportunity to begin building savings, an often-overlooked aspect of financial health when debt payments are high. Whether it’s an emergency fund, a down payment for a home, or a retirement nest egg, every dollar saved contributes to long-term security. The psychological relief of having more money at the end of the month cannot be overstated; it reduces financial anxiety and allows individuals to focus on other aspects of their lives. Essentially, reduced payments inject vital liquidity back into the household, empowering consumers to make healthier financial choices and improve their quality of life.

Improving Credit Scores

Consistently making lower, more manageable payments can have a positive ripple effect on an individual’s credit score. When debt payments become more affordable, borrowers are less likely to miss payments or default, both of which are detrimental to credit health. A track record of on-time payments, even if the amounts are reduced through federal programs, demonstrates responsible financial behavior to credit bureaus. This steady adherence to repayment schedules contributes directly to an improved payment history, a critical factor in credit score calculations.

Furthermore, by reducing the overall debt burden, these programs can also help to lower a borrower’s credit utilization ratio—the amount of credit used compared to the total available credit. A lower utilization ratio signals less risk to lenders, which can also positively influence credit scores. An improved credit score opens doors to better interest rates on future loans, easier access to credit, and more favorable terms on everything from mortgages to car loans. It creates a virtuous cycle where present debt relief paves the way for future financial opportunities, making credit a tool rather than a burden.

Long-Term Financial Stability

The ultimate goal of federal debt relief programs is to foster long-term financial stability for Americans. By cutting monthly payments by up to 30%, these initiatives help prevent individuals from falling into deeper debt cycles and enable them to build a stronger financial foundation. It allows borrowers to shift their focus from merely surviving financially to actively planning for the future. This includes the ability to save for retirement, invest in education, or even start a small business, all of which contribute to personal and national economic growth.

Reduced debt burdens also free individuals from the constant stress and anxiety associated with high payments, improving mental health and overall well-being. This stability is not just about individual households; it has broader economic implications. A financially stable populace is more likely to spend, invest, and contribute to the economy, creating a more robust and dynamic market. The federal programs, therefore, serve as a vital tool for both immediate relief and for cultivating a resilient, prosperous society. It is an investment in the human capital of the nation, ensuring that citizens have the capacity to thrive.

Common Pitfalls and How to Avoid Them

While federal debt relief programs offer significant advantages, borrowers must approach them with diligence to avoid common pitfalls that could jeopardize their benefits or lead to future complications. Understanding potential challenges and preparing for them proactively is crucial for maximizing the effectiveness of these programs. The goal is to leverage relief opportunities wisely, securing long-term financial health rather than falling into new traps. Avoiding these missteps requires careful attention to detail and a clear understanding of personal financial responsibilities.

Misunderstanding Program Terms

One of the most frequent pitfalls is a fundamental misunderstanding of the program’s terms and conditions. Each federal debt relief program has specific eligibility criteria, repayment structures, interest rate policies, and potential tax implications. Failing to fully grasp these details can lead to unexpected consequences, such as missed deadlines, incorrect payment calculations, or even unintended tax liabilities after loan forgiveness. Many borrowers focus solely on the immediate benefit of lower payments without fully comprehending the long-term commitments or requirements.

For instance, some income-driven repayment plans may extend the repayment period, leading to more interest paid over the life of the loan, even if monthly payments are lower. PSLF requires very specific employment and payment types; a misstep here can invalidate years of qualifying payments. It is absolutely essential to read all documentation thoroughly, ask questions, and seek clarification from official sources or trusted financial advisors. Don’t rely on assumptions or hearsay; accurate information is your most valuable asset when dealing with federal programs.

Ignoring Communication from Servicers

Another critical mistake is ignoring communication from loan servicers or federal agencies. These communications often contain vital information about your loan status, changes to program terms, reminders for annual recertification, or notifications of upcoming deadlines. Disregarding these notices can lead to enrollment termination, increased payments, or even default. In the age of digital correspondence, it’s easy for important emails to get lost in spam folders or for physical mail to go unread.

It is imperative to keep your contact information updated with all relevant servicers and agencies and to regularly check your mail and email. Set up alerts, if possible, for official communications. Missing a recertification deadline for an IDR plan, for example, can cause your payments to revert to the standard amount, potentially creating a significant financial shock. Proactive engagement with your servicers ensures that you stay informed, maintain your eligibility, and continue to receive the benefits you qualify for.

Failing to Recertify Annually

Many federal debt relief programs – especially income-driven repayment plans – require annual recertification of income and family size. This recurring requirement is often overlooked, leading to abrupt changes in payment amounts or even involuntary removal from the program. The recertification process ensures that your monthly payments remain accurately aligned with your current financial situation. If you fail to recertify, your payments may automatically increase, or any accrued unpaid interest might be capitalized, adding to your principal balance.

It is advisable to mark your calendar and set multiple reminders for your annual recertification date. Many loan servicers will send reminders, but it is ultimately the borrower’s responsibility to complete this process on time. Gathering the necessary income documentation (such as your latest tax return) well in advance can make the recertification process quick and painless. Consistency in this annual task is crucial for maintaining the continuity of your debt relief benefits. Treat recertification as seriously as your monthly payments to avoid unnecessary financial setbacks.

Future Outlook for Federal Debt Relief

The landscape of federal debt relief is dynamic, constantly evolving in response to economic conditions, legislative priorities, and the changing needs of American families. While 2025 brings significant enhancements, the future holds further potential for refinement and new initiatives. Understanding this evolving outlook can help borrowers stay prepared and informed, ensuring they can adapt their financial strategies to new opportunities. The commitment to addressing debt remains a key policy objective, signaling continued support for mechanisms that promote financial stability.

Potential Legislative Changes

The discussion around federal debt relief is frequently influenced by legislative developments in Congress. Future changes could include new laws that further expand eligibility for existing programs, introduce entirely new forms of relief, or refine how federal loans are administered. These legislative changes often reflect shifts in political priorities or responses to emerging economic challenges. For instance, discussions about student loan reform are ongoing, and future legislation could lead to even more generous forgiveness options or broader adjustments to interest rates.

Keeping an eye on legislative proposals and financial news from Capitol Hill is a wise strategy for anyone with federal debt. Proposed bills often undergo public comment periods, providing an opportunity for citizens to voice their opinions. Engaging with these processes can help shape the future of debt relief policies. While predicting exact outcomes is challenging, it is clear that federal debt will remain a significant topic in national policy debates, implying a continued focus on finding effective solutions for borrowers across the nation.

Emerging Technologies and Debt Management

The integration of emerging technologies is poised to play a greater role in federal debt management and relief programs. Artificial intelligence (AI), machine learning, and blockchain technology could streamline application processes, enhance data security, and offer more personalized debt management advice. AI-powered tools might help borrowers identify the most suitable relief programs faster, based on their unique financial profiles, reducing administrative burdens. This technological advancement could make the system more efficient and user-friendly, reducing barriers to access for many.

Furthermore, digital platforms could facilitate easier recertification, automated payment adjustments, and better communication between borrowers and servicers. The goal is to leverage technology to make debt relief programs more accessible, transparent, and responsive to individual needs. While these advancements are still evolving, they represent a promising future where managing federal debt becomes a less cumbersome and more intuitive process, allowing borrowers to focus on their financial recovery with greater ease and confidence.

Advocacy and Public Awareness

Ongoing advocacy efforts and public awareness campaigns will continue to shape the future of federal debt relief. Organizations representing borrowers, consumer protection groups, and financial literacy advocates play a crucial role in highlighting the challenges faced by indebted Americans and pushing for policy changes. Their collective voice helps to keep debt relief on the political agenda and ensures that program administrators remain accountable to the needs of the public. Increased public awareness also empowers borrowers with knowledge, helping them to navigate the existing system more effectively and to demand further improvements.

These efforts are vital for ensuring that new programs are not only enacted but are also effectively implemented and understood by those who stand to benefit. Grassroots movements and online petitions can draw attention to specific issues, influencing legislative action and program design. By staying informed about these advocacy efforts and potentially participating in them, individuals can contribute to a future where federal debt relief programs are even more comprehensive, just, and effective in fostering financial well-being for all. The more collective understanding and push there is, the stronger the support systems become.

| Key Point | Brief Description |

|---|---|

| 💰 Payment Reduction | New 2025 federal programs aim to cut monthly payments by up to 30%, alleviating financial strain. |

| 📚 Program Enhancements | IDR and PSLF programs are enhanced with lower discretionary income calculations and simplified eligibility. |

| ✅ Simplified Processes | Focus on streamlining applications and making forgiveness paths clearer for borrowers. |

| 🔮 Future Outlook | Continued legislative focus and technology integration promise further improvements in debt management. |

Frequently Asked Questions About 2025 Federal Debt Relief

The 2025 federal debt relief programs primarily target federal student loans, including Direct Loans and some FFEL Program loans. Additionally, there may be new initiatives or adjustments for other federal obligations such as FHA mortgages, VA loans, and certain agricultural or small business loans, though student loans remain a significant focus. Each program has specific criteria, so checking the debt type is essential.

Eligibility typically depends on factors like income, family size, the type of federal debt you hold, and your employment status for certain programs (e.g., PSLF). The best way to confirm is to visit the official websites of relevant federal agencies, such as studentaid.gov for student loans. They provide detailed criteria, eligibility checkers, and comprehensive application guides to help you determine your qualification status.

Generally, you will need proof of income (tax returns, pay stubs), identification (driver’s license, social security number), and detailed information about your federal loan accounts. Programs focusing on specific circumstances might also require documentation of family size, employment verification, or evidence of financial hardship like medical bills or unemployment records.

Yes, several federal programs are designed to assist borrowers in default or at risk of default. Options like loan rehabilitation or consolidation can help bring your loans back into good standing, making you eligible for income-driven repayment plans and other long-term relief options. It’s crucial to act promptly and communicate with your loan servicer or the Department of Education to explore these pathways.

Debt forgiveness, under certain circumstances, might be considered taxable income by the IRS. However, there are exceptions, particularly for specific types of federal student loan forgiveness (e.g., PSLF). It is highly recommended to consult a tax professional or refer to IRS guidelines to understand the potential tax implications of any debt forgiven through these programs to avoid surprises.

Conclusion

The advent of new federal debt relief programs in 2025 represents a critical opportunity for millions of Americans grappling with financial burdens. With the potential to cut monthly payments by up to 30%, these initiatives offer not just immediate financial breathing room, but also a viable pathway to long-term economic stability. By understanding the enhanced Income-Driven Repayment plans, modified Public Service Loan Forgiveness options, and targeted relief for other federal debts, eligible individuals can proactively engage with these resources. Diligence in navigating eligibility, preparing documentation, and avoiding common pitfalls will ensure that borrowers maximize the benefits and pave the way for a more secure financial future. Staying informed and utilizing these programs wisely can fundamentally transform an individual’s relationship with debt, fostering greater peace of mind and economic freedom.