Master Your Finances: The Psychology of Budgeting and Emotional Spending

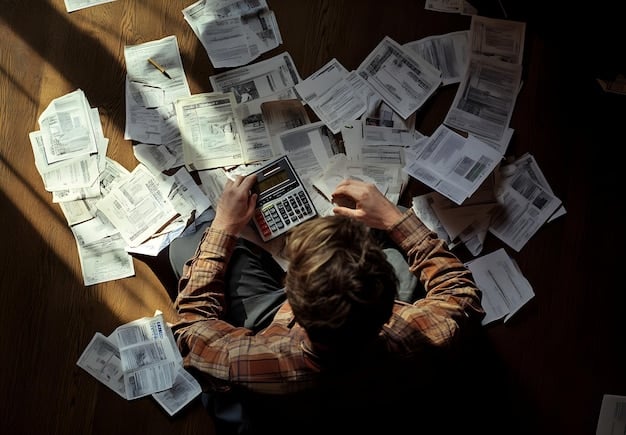

The psychology of budgeting involves understanding the emotional drivers behind spending habits and developing strategies to manage them effectively, ultimately leading to better financial control and stability.

Budgeting isn’t just about crunching numbers; it’s deeply intertwined with our emotions. Understanding the psychology of **budgeting: how to overcome emotional spending** is crucial for achieving financial well-being.

Understanding the Emotional Landscape of Budgeting

Budgeting can evoke a range of emotions, from anxiety and stress to feelings of restriction and deprivation. Recognizing these emotional triggers is the first step towards mastering your financial behavior. We need to understand the emotional impact of budgeting to create sustainable habits.

The Role of Emotions in Financial Decisions

Emotions often override logic when it comes to spending. Understanding how emotions influence financial choices is crucial for creating a budget that works with, rather than against, human nature.

Common Emotional Triggers for Overspending

Certain situations and feelings can trigger emotional spending. Identifying these triggers allows for proactive strategies to prevent impulsive purchases. Some triggers might include:

- Stress and Anxiety: Retail therapy can provide temporary relief but leads to long-term financial strain.

- Sadness and Loneliness: Emotional voids can be filled by buying things, leading to unnecessary expenses.

- Celebrations and Rewards: Overindulgence during celebrations can quickly derail a budget.

Ultimately, understanding the emotional landscape of budgeting is critical for creating a sustainable financial plan. Acknowledging and addressing these emotional triggers leads to more informed and intentional spending habits, setting the stage for financial well-being.

Identifying Your Spending Personality

Everyone approaches money differently. Understanding your spending personality can reveal patterns and tendencies that impact your budget. We all have unique ways of interacting with our finances.

The Impulsive Spender

Impulsive spenders often make spontaneous purchases without considering the consequences. This can lead to debt and a feeling of lack of control over finances.

The Avoidant Spender

Avoidant spenders tend to ignore their finances, leading to missed opportunities for saving and investment. This avoidance is often rooted in fear or anxiety about money.

The Saver

Savers prioritize saving and often feel guilty about spending money, even on necessary items. While saving is important, it’s crucial to find a balance between saving and enjoying life.

Recognizing your spending personality is a crucial step toward developing a budgeting strategy that aligns with your natural inclinations. It allows you to address your weaknesses while capitalizing on your strengths.

Strategies to Overcome Emotional Spending

Overcoming emotional spending requires a combination of self-awareness, behavioral techniques, and practical strategies. We have to address our behavior to overcome emotional spending.

Mindful Spending

Practicing mindfulness can help you become more aware of your spending habits. Paying attention to your thoughts and feelings before making a purchase can prevent impulsive decisions.

The 24-Hour Rule

Before making a non-essential purchase, wait 24 hours. This cooling-off period allows you to assess whether the item is truly needed or just a fleeting desire.

Creating a “Reasons to Save” List

Write down your goals for saving money, such as a down payment on a house, a vacation, or retirement. Reviewing this list when tempted to overspend can reinforce your commitment to your financial goals.

Adopting these strategies can help individuals develop a healthier relationship with their finances. Mindful spending, the 24-hour rule, and having clearly defined savings goals are all effective tools for overcoming emotional spending and building a more secure financial future.

Building a Budget That Works With Your Emotions

A budget should be a tool for empowerment, not a source of stress. Creating a budget that considers your emotional needs can increase its effectiveness and sustainability. It must be personalized to avoid emotional traps.

Allocate Funds for “Fun Money”

Include a line item in your budget for discretionary spending. This allows you to indulge in occasional treats without feeling guilty or derailing your financial plan.

Set Realistic Goals

Avoid setting overly restrictive goals that are difficult to achieve. Start with small, manageable changes and gradually increase your savings goals over time.

Reward Yourself for Achieving Milestones

Celebrate your progress by rewarding yourself for reaching your financial goals. This reinforces positive behavior and keeps you motivated.

Ultimately, building a budget that aligns with your emotions makes it more likely that you’ll stick to it. Allocating funds for fun, setting achievable goals, and celebrating milestones contribute to a positive budgeting experience.

Seeking Support and Accountability

Sometimes, overcoming emotional spending requires outside support. Talking to a financial advisor, therapist, or trusted friend can provide valuable insights and accountability. We don’t have to do this alone; support is available.

Financial Counseling

A financial counselor can help you develop a personalized budget and provide guidance on managing debt and achieving your financial goals.

Therapy

If emotional spending is linked to deeper psychological issues, therapy can help you address the root causes and develop healthier coping mechanisms.

Accountability Partners

Enlist a friend or family member to hold you accountable for your spending habits. Share your budget and goals and check in regularly to discuss your progress.

Seeking support and accountability can significantly enhance your efforts to overcome emotional spending. Whether it’s through financial counseling, therapy, or accountability partners, having a support system can provide valuable insights and motivation along the way.

Maintaining Long-Term Financial Wellness

Overcoming emotional spending is an ongoing journey, not a one-time fix. Developing sustainable habits and staying committed to your financial goals are essential for long-term success. Consistency is key for lasting change.

Regularly Review Your Budget

Review your budget regularly to ensure it still meets your needs and goals. Make adjustments as needed to reflect changes in your income, expenses, or priorities.

- Monthly Check-ins: Set aside time each month to review your spending and identify areas for improvement.

- Annual Overhaul: Conduct a thorough review of your budget annually to ensure it aligns with your long-term financial goals.

Stay Informed About Personal Finance

Continue to educate yourself about personal finance by reading books, articles, and blogs. The more you know, the better equipped you’ll be to make informed financial decisions.

Practice Self-Compassion

Be kind to yourself when you make mistakes. Everyone slips up from time to time. The important thing is to learn from your mistakes and get back on track.

Maintaining long-term financial wellness requires continuous effort and commitment. Regularly reviewing your budget, staying informed about personal finance, and practicing self-compassion all contribute to a healthier and more secure financial future.

| Key Point | Brief Description |

|---|---|

| 💡Emotional Triggers | Recognizing feelings that lead to overspending. |

| ⏳24-Hour Rule | Waiting before making non-essential purchases. |

| 🎯Savings Goals | Defining clear reasons for saving money. |

| 🤝Seeking Support | Getting help from counselors or accountability partners. |

Frequently Asked Questions

▼

Emotional spending is when your purchasing decisions are driven by feelings rather than rational thought. This can lead to overspending and financial instability.

▼

Keep a spending diary and note when you feel compelled to buy something. Identify the emotions you were experiencing at the time, like stress, sadness, or boredom.

▼

The 24-hour rule means waiting 24 hours before making a non-essential purchase. This gives you time to consider whether you really need the item or if it’s an impulse buy.

▼

A budget provides structure and awareness. By allocating funds for specific categories, including “fun money,” you can manage your spending consciously and prevent overspending.

▼

If your emotional spending is causing significant debt, stress, or relationship problems, consider seeking help from a financial counselor or therapist. They can offer personalized strategies.

Conclusion

Understanding the psychology of budgeting is paramount to overcoming emotional spending. By identifying triggers, adopting mindful spending habits, and building a supportive financial ecosystem, individuals can achieve long-term financial wellness and cultivate a healthier relationship with their money.